Getting started with crypto in 2026 is easier than ever — but understanding how you onboard matters more than most beginners realize.

For many people, buying crypto starts with a simple question:

“Where can I buy Bitcoin or Ethereum?”But a more important question quickly follows:

Who actually controls my crypto once I’ve bought it?

In today’s crypto ecosystem, onboarding is not just about converting fiat into digital assets. It’s about choosing between convenience and control, custody and ownership, and short-term simplicity versus long-term security.

Most users begin their journey on centralized platforms. That’s normal — and often practical.

However, as users gain experience, many discover that self-custody—holding crypto in wallets where you control the private keys—plays a crucial role in reducing risk and increasing financial autonomy.

This guide explores the three main ways to onboard into crypto in 2026, explains how each process works, and shows how they fit into a long-term crypto strategy that emphasizes how to onboard into crypto effectively.

What Does “Self-Custody” Mean in Crypto?

Before diving into onboarding methods, it’s important to understand one core concept.

Self-custody means that you control your private keys — not an exchange, not a platform, not a third party.

If you control the keys, you control the crypto.

This idea comes directly from the original vision of Bitcoin, as described in the Bitcoin whitepaper by Satoshi Nakamoto.

In practice:

- Exchanges are custodial (they hold keys for you)

- Software wallets and hardware wallets can be non-custodial

- Self-custody reduces counterparty risk and reliance on intermediaries

Understanding this distinction makes every onboarding decision clearer.

1. Centralized Exchanges (CEXs): The Most Common Entry Point

Centralized exchanges remain the most widely used way to buy crypto in 2026, especially for first-time users.

How onboarding via an exchange works

- Create an account on a centralized exchange

- Complete identity verification (KYC)

- Deposit fiat currency (bank transfer, debit/credit card, Apple Pay, Google Pay)

- Buy cryptocurrencies such as Bitcoin, Ethereum, or stablecoins

- Optionally withdraw crypto to a personal wallet

Popular platforms include Coinbase, Binance, and Kraken.

Why exchanges are popular

- Simple user experience

- High liquidity and fast execution

- Easy fiat integration

- Strong presence in regulated markets

The custody trade-off

When you buy crypto on an exchange, your assets are custodial by default: the platform holds and secures your funds.

This is a trade-off rather than a drawback — exchanges are designed for trading. The key is to use them for what they do best, then withdraw your assets to your own wallet once the transaction is complete.

👉 Read our detailed page to better understand the difference between custodial platforms and self-custody.

Best suited for

- First-time buyers

- Large fiat purchases

- Users prioritizing convenience

2. Wallet-Based Onramps: Buy Crypto While Keeping Control

Wallet-based onramps have become one of the fastest-growing onboarding methods in 2026, especially among users who want ownership without complexity.

How wallet onramps work

- Download a non-custodial software wallet

- Secure your recovery phrase

- Buy crypto directly inside the wallet using integrated onramps

- Receive crypto straight into your wallet

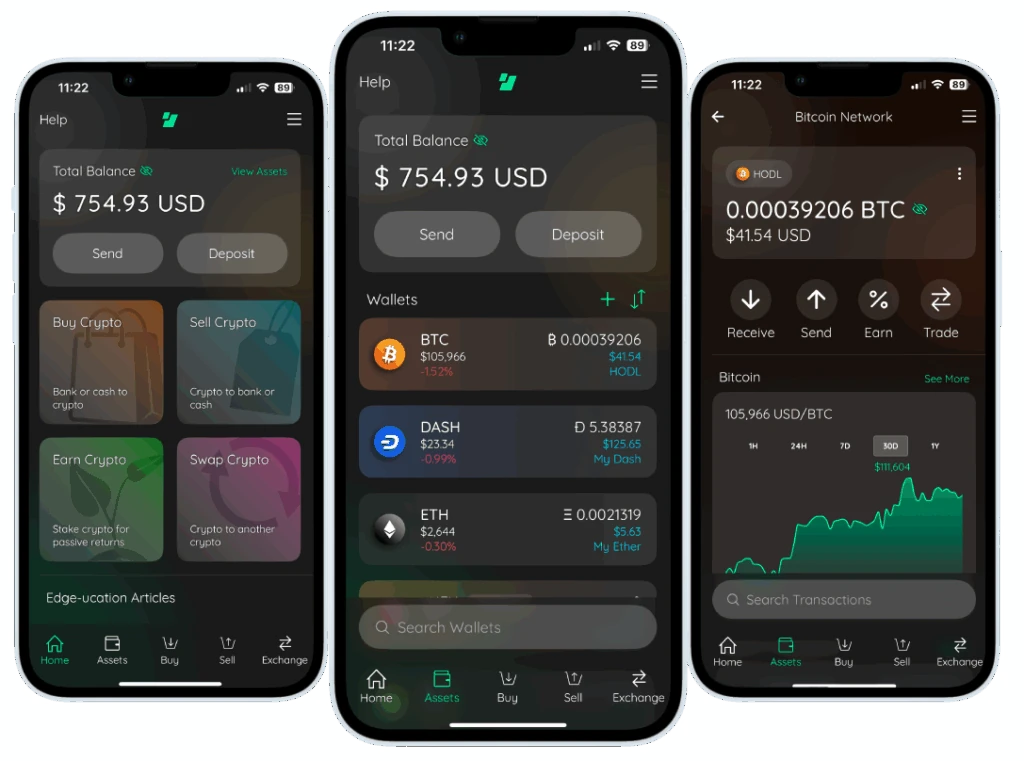

A strong example is Edge Wallet, which allows users to buy crypto directly while maintaining control of their private keys.

Why this method is gaining adoption

- You own your crypto from day one

- No withdrawal step required

- Direct access to DeFi, payments, and Web3 apps

- Reduced reliance on centralized platforms

See our full hands-on Edge Wallet Review (includes tutorials and videos)

Best suited for

- Users moving toward self-custody

- Long-term holders

- DeFi and on-chain users

3. Peer-to-Peer (P2P) Onboarding: Global and Flexible

Peer-to-peer onboarding remains essential in 2026, particularly in regions where banking access is limited.

How P2P onboarding works

- Find a seller via a P2P platform or local broker

- Agree on price and payment method

- Send payment (bank transfer, mobile money, cash, etc.)

- Receive crypto directly into your wallet

This method often relies on stablecoins like USDT or USDC and escrow mechanisms.

Why P2P matters globally

- Works beyond traditional banking rails

- Popular in India, Africa, LATAM, and SEA

- Supports local payment methods

- Increases financial access

Best suited for

- Users without reliable banking access

- Stablecoin users

- Cross-border payments and remittances

How to Choose the Right Crypto Onboarding Method in 2026

| User Profile | Recommended Method |

|---|---|

| First-time buyer | Centralized exchange |

| Long-term holder | Wallet-based onramp |

| DeFi user | Wallet-based onramp |

| Limited banking access | P2P onboarding |

A Note on Fees and Exchange Rates

While security and custody are critical factors, cost is often the first concern for new users.

If your primary criterion is getting the best exchange rate with the lowest fees, centralized exchanges are often the most competitive option.

Why exchanges usually offer better rates

- They aggregate high liquidity from many buyers and sellers

- Trading fees are typically lower than onramps embedded in wallets

- Bank transfers on exchanges often come with minimal or zero fees

- Price spreads are generally tighter

For users making larger fiat-to-crypto purchases, this can result in noticeable savings compared to wallet-based onramps or P2P transactions.

The trade-off to understand

Lower fees usually come with a trade-off: custody.

When buying on an exchange, your crypto is held by the platform until you withdraw it. This means:

- You rely on a third party to secure your funds

- Access to your crypto can be affected by platform outages, withdrawals limits, or policy changes

For many users, a common and reasonable approach in 2026 is:

Buy crypto on an exchange for better rates, then withdraw to a self-custodial wallet for long-term storage.

This hybrid approach balances cost efficiency with ownership and security, and fits well with a progressive crypto onboarding strategy.

Next Step: From Onboarding to Safe Storage

Once you understand how to buy crypto, the next critical step is how to store it safely.

This is where self-custody wallets come in:

- Non-custodial software wallets for flexibility and daily use

- Hardware wallets for long-term, high-security storage

These tools reduce counterparty risk and put you in full control of your assets.

Ready to Take Control of Your Crypto?

Go deeper into self‑custody, software wallets, hardware wallets, and practical guides.

What is the best way to onboard into crypto in 2026?

The best way to onboard into crypto in 2026 depends on your goals. Beginners often start with centralized exchanges for simplicity, while long-term users prefer wallet-based onramps and self-custody to gain more security and control over their assets.

Final Thoughts: Ownership Is the Real Goal

Onboarding into crypto is only the beginning.

Centralized exchanges make crypto accessible. Wallet-based onramps introduce ownership. P2P methods expand global access. But over time, one lesson becomes clear:

If you don’t control the private keys, you don’t fully control the crypto.

In 2026, the smartest approach for beginners is progressive:

- Start where onboarding feels easiest

- Learn how custody works

- Move toward self-custody as confidence grows

Education is your strongest protection in crypto.

And real ownership starts with self-custody.

Java‑certified engineer and P2PStaking CEO, I secure validators across Solana, Polkadot, Kusama, Mina, and Near. My articles reflect hands‑on wallet ops and real recovery drills so you can set up self‑custody safely, step by step.

Frequently Asked Questions (FAQ)

Is self-custody safer than exchanges?

Self-custody can be safer in the long term because you control your private keys and do not rely on a third party to secure your funds. Exchanges are convenient but expose users to counterparty risk, such as hacks, withdrawal freezes, or platform failures. Self-custody requires more responsibility but offers greater ownership and control.

Do I need KYC to buy crypto in 2026?

In most cases, yes. Centralized exchanges and many wallet-based onramps require Know Your Customer (KYC) verification to comply with regulations. However, the level of KYC varies by platform and country. Some peer-to-peer (P2P) methods may allow buying crypto with minimal or no KYC, depending on local regulations and payment methods.

Can I buy crypto without a bank account?

Yes, it is possible. Peer-to-peer (P2P) onboarding allows users to buy crypto using alternative payment methods such as mobile money, cash, or local payment apps. This approach is common in regions where traditional banking access is limited, including parts of Africa, India, and Southeast Asia.

Should I leave my crypto on an exchange after buying?

Leaving crypto on an exchange may be convenient for trading, but it is generally not recommended for long-term storage. For better security and ownership, many users withdraw their funds to a self-custodial software wallet or a hardware wallet once the purchase is complete.

What is the difference between a software wallet and a hardware wallet?

A software wallet is an app installed on your phone or computer that allows you to manage crypto easily and access DeFi services. A hardware wallet is a physical device designed to store private keys offline, offering higher security for long-term storage. Both can be non-custodial, meaning you control the private keys.